-

funds

-

investment

-

assent management

-

adviser support

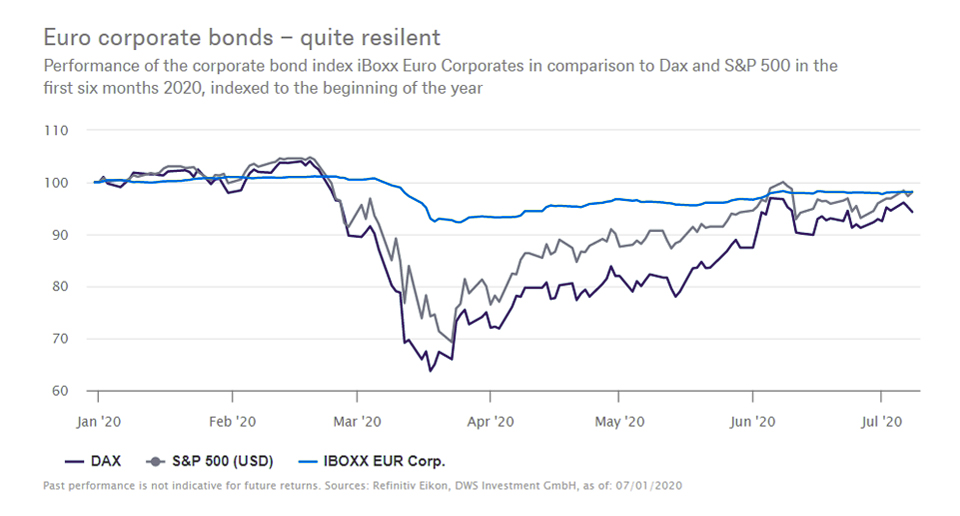

Why now could be a good time to buy corporate bonds

Early this year, many European fixed-income investors were searching for investments providing a good return. The loose monetary policy pursued by the European Central Bank (ECB) had resulted in low yields for government bonds. In addition to the central bank, the prospect of moderate economic growth with comparatively low default rates and the purchase of corporate bonds by the ECB in this sector resulted in high prices and low yields. Some investors seeking greater performance therefore migrated to more risky sectors and pursued high-yield bonds from companies with lower credit ratings.

«Bond investors gravitate toward government bonds. But corporate bonds with a good credit rating may actually be a better alternative. For government bonds, the potential for good yields and diversification has greatly shrunk during the recent price gains. It may therefore be a good time to increase the percentage of corporate bonds in portfolios.»

What is the outlook for Euro-denominated corporate bonds? That depends greatly on the current pandemic. Analysts currently expect the eurozone economy to begin growing again in the third quarter already. That boosts hopes that the risk of corporate defaults will at least remain stable. The European Central Bank also played a key role, by announcing that it intended to continue its loose monetary policy. Eurozone government bond yields should therefore remain low enough to make corporate bonds attractive as a higher-yielding alternative.

Choosing the right bonds and having the right timing both require extensive knowledge and experience. These are all good reasons for allowing a professional fund manager to actively handle the analysis and specific investment decisions, one who specializes in this asset class. Even if the prospects are good, remember that corporate bonds are subject to risks ranging from price decline to total loss if the borrower can no longer repay the debt - and this applies to bonds with a good credit rating as well.